Risk Management

CSV Goals (Creating Shared Value)

Managing Risk and Leveraging Opportunities

Creating a resilient business

At CCBJH we have implemented a business resilience program that integrates the ways in which we manage risk and opportunity to enable profitable growth, protect our people and assets, enhance our capabilities to respond in a crisis, and leverage insurance to protect us financially. Central to our program is having empowered teams that understand and respond with agility to risks and opportunities, adaptable leadership that responds to a crisis, and programs that develop our people and process capabilities to support both a short-term response and longterm resiliency strategy.

The process incorporates the review of our constantly changing business environment and the assessment of current and over-the-horizon risks and associated opportunities. Our people develop and implement plans to manage key risks and we maintain a focus on being able to continue operations and serve our customers in the event of disruptions. For that purpose we have well-established crisis management and business continuity plans and a program that trains our crisis leaders at least annually through interactive simulations.

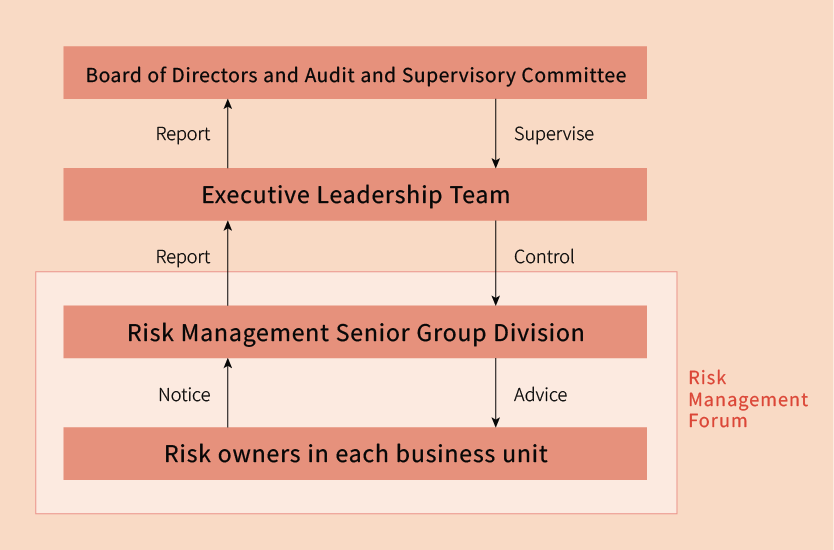

Risk Management System

The CCBJH Board has overall responsibility for our businessresilience strategies with enterprise risk management(ERM) being a central pillar. The Board is closely involvedin overseeing our current and over-the-horizon risks, thestrategic response to them, and monitoring managementactions that strengthen resilience in support of our strategicbusiness plan “Vision 2028” objectives. Our businessresilience programs are led by our Head of Risk Management,who as a member of the ELT works in close collaborationwith the function heads and risk owners across our businesson the response to specific business risks. He is tasked withmaintaining a wide-angled view of our business streamsfor emergent risks and opportunities and through regularreporting ensures that risk visibility is provided to our ELT,the Audit and Supervisory Committee and the full Board.

ERM Framework

Our ERM framework has adopted the coreelements of COSO and ISO 31000 to provide a PDCArisk framework aimed at driving profitable growth byleveraging opportunities and promoting appropriate riskbaseddecision-making, as well as strong capabilities in theidentification and response to foreseeable risks.The ERM program incorporates a variety of elementsthat enable us to ensure alignment to our business strategies,objectives, and principles; drives integration with ourstrategic direction, ethics and values; links into the businessplanning cycle; continually monitors our internal and externalenvironment for factors that may change our risk profile andcreate opportunities; and conducts an annual evaluationof the type and amount of insurance we should purchase.Our approach to insurance risk transfer is influenced by theavailability of insurance cover and cost, measured againstthe probability and magnitude of the relevant risks.Our risks and the associated mitigation and responseinitiatives are constantly evaluated. The Audit and SupervisoryCommittee are provided quarterly updates on the full programwith the Board of Directors receiving biannual updates. Theprogram is regularly audited by our Internal Audit team andexternal auditors against global best practice.In 2023, we continued to strengthen the integration ofERM and Smart Risk program into our corporate culture andbusiness DNA through the roll out of training and awarenesscourses. We have maintained the visibility of risks andopportunities through regular ELT dialogue and quarterlysenior manager participation in facilitated functional risk andopportunity identification and review sessions.

Enterprise Risk Management (ERM) processes

Major Risks

Our integrated business resilience program enables us to be vigilant to uncertainties in our operating environment and proactively identify new risks and profitable growth opportunities.

The cyclic review of our key risks involves an assessment of their likelihood of occurrence, potential consequences and speed of onset, and evaluation of the strategies to manage them. Our list does not include all risks that could ultimately affect us as there are risks that are not yet known to us, and risks currently evaluated as immaterial that could ultimately impact on our business or financial performance.

Climate change is a key risk to our operations over the longer term but while a risk, it can present significant opportunities that we can leverage though proactive preparation of our business with well-thought-out adjustments to strategy and capital investments. Climate risk is integrated into our risk management dialogue at all levels and a priority focus are of our Risk Management Forum and Sustainability Committee which drive alignment to TCFD and TNFD strategies.

While in 2024 we did not observe material changes to our reportable risks, we did see reprioritization of risks as illustrated in the table.

| Risk category | Description and potential impacts | Key mitigations |

|---|---|---|

| Cyber Security and Systems | Business activities being impacted and/or confidential information leaking caused by system failures or cyber incidents.

|

|

| People Talent (Attraction and Retention) | Not being able to secure, retain and develop sufficient human resources and build constructive relationships with labor unions due to business performance, aging population, and a competitive employment environment.

|

|

| Health and Safety | Lack of compliance with safety systems, ownership or accountability and awareness, mental health issues, and the use of aging equipment cause serious workrelated health and safety incidents.

|

|

| Growth Strategies | Failure to implement measures to improve our competitive advantage and grow the business through transformation (such as business integration, joint ventures, capital investments, project management etc.) due to people capabilities.

|

|

| Changing Consumer Mindset | Changes in consumer preferences caused by concerns over sugar consumption and increased health awareness, or pricing.

|

|

| Evolving Commercial and Competitor Landscapes | Inability to respond to changes in the retail and competitive environment effectively, efficiently and with agility.

|

|

| Manufacturing, Logistics & Infrastructure | The stable supply of goods being impeded due to issues in production and logistics operations, or changes in weather and consumer behaviors.

|

|

| Natural Disasters | Death and injury of employees, damage to business facilities for production, logistics and sales operations caused by events, such as, earthquakes and floods

|

|

| Sustainability | Failing to respond to changes in stakeholders' awareness of sustainability including climate change risks and/or inadequately reporting on sustainability and ESG topics in line with stakeholder and regulatory requirements.

|

|

| Climate change | Becoming short of raw materials including water and agricultural products due to climate change.

|

|

| Quality and Food Safety | Product related quality and food safety incidents

|

|

| Regulatory Compliance and Ethics | Violations of laws, internal regulations, and our code of ethical conducts.

|

|

| Franchise relationships | Risk related to our high dependency on, or changes to our relationship with TCCC and CCJC as trademark owners in respect to contract / relationship terms and renewals, concentrate pricing, support for product promotions.

|

|

| Commodity Pricing | Significant increase in procurement costs due to fluctuations in foreign exchange rates, raw material shortages, and commodity price increases.

|

|